Rising sea levels are not a distant threat in Florida, USA — they are an immediate business risk for coastal communities, insurers, real estate investors, and governments. According to National Oceanic and Atmospheric Administration (NOAA), sea levels along the US Southeast coast are projected to rise between 0.6 and 0.9 meters (2–3 feet) by 2100 under intermediate scenarios. This incremental rise, coupled with storm surge and tidal flooding, is expected to increase property losses and disrupt infrastructure decades before full inundation occurs.

An investment firm managing multi-family residential properties in Miami-Dade County aimed to determine not only ‘if’ but also ‘when’ each property could encounter operational risks. Their key goals were:

- pinpoint direct inundation timelines

- assess indirect impacts from disrupted access and infrastructure, and

- present asset-specific data to insurers for coverage negotiations.

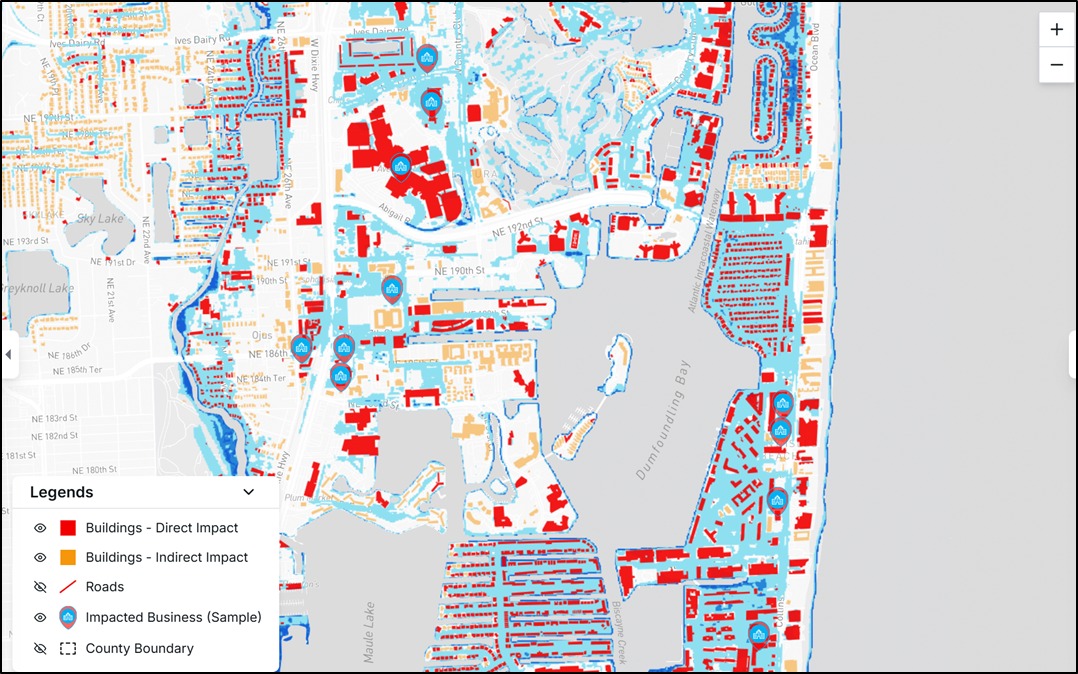

TECHG-X’s AssetRx – Sea Level Rise Insight Hub provided high-resolution, building-level risk analysis by integrating NOAA-projected inundation data with county building footprints, road networks, elevation models, and property valuation datasets. By modeling multiple climate scenarios (Intermediate and Intermediate-High) for time horizons up to 2090, AssetRx generated key performance indicators including:

- Risk Score (0–100) – indicating vulnerability level

- Direct Inundation Year – the earliest year water depth exceeds critical building thresholds

- Indirect Impact Year – when the surrounding access infrastructure becomes inoperable

- Projected Economic Loss Value – estimated replacement cost and market value impact

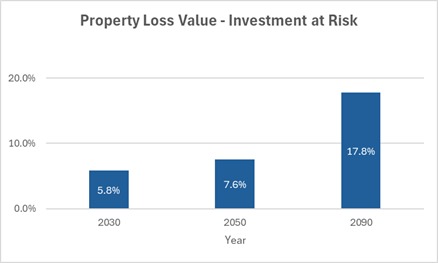

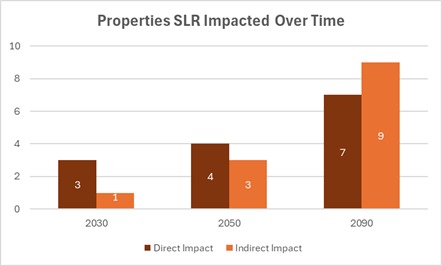

For a multi-family real estate investment firm holding 15 Miami-Dade assets with approximately a USD 75 Mn portfolio, AssetRx’s SLR Intermediate-scenario analysis indicates:

- About 47% of properties face direct inundation by 2090, with the earliest direct impacts by 2030

- Indirect disruptions (loss of road) are broader—about 60% show indirect impacts by 2090.

- Cumulative projected building loss by 2090 is ~USD 14 Mn

Multi-family residential properties portfolio analysis

For the insurer involved in the project, these insights were transformative. By integrating AssetRx’s building-level risk data into their underwriting process, they could:

- Adjust premium pricing dynamically based on asset-specific risk profiles

- Offer conditional coverage extensions tied to implementation of resilience measures (elevated access roads, flood barriers, drainage upgrades)

- Identify high-risk zones to diversify portfolios and lower claims exposure for the next 30 years.

For the investment firm, the analysis guided decisions on which assets to upgrade, sell, or replace with safer inland investments to reduce climate risk. Sharing detailed data with local authorities also helped inform broader infrastructure planning.

This case highlights that for insurers and investors, significant sea level rise risks often emerge well before properties are actually flooded. Using building-level projections enables proactive strategies to protect both asset value and community resilience as coastal threats increase.