Governments across the world have been facilitating favourable environments for implementing projects with private sector players. While these efforts have brought some momentum, there remains a substantial ground to cover in terms of identifying suitable PPP business models, developing robust governance frameworks, improving government support mechanisms and capacity readiness, deploying transparent procurement processes, and ensuring macroeconomic stability, among other measures to enable mature geospatial PPPs.

Geospatial PPP Business Models

The focus for governments, when it comes to PPPs, is to find ways to leverage private sector investment through sound, consistent and sustained policies coupled with pragmatic business models. However, there exists no single formula or business model that can be applied across the board. PPP structures vary according to the unique demands of the projects in different sectors, reflecting the needs of governments.

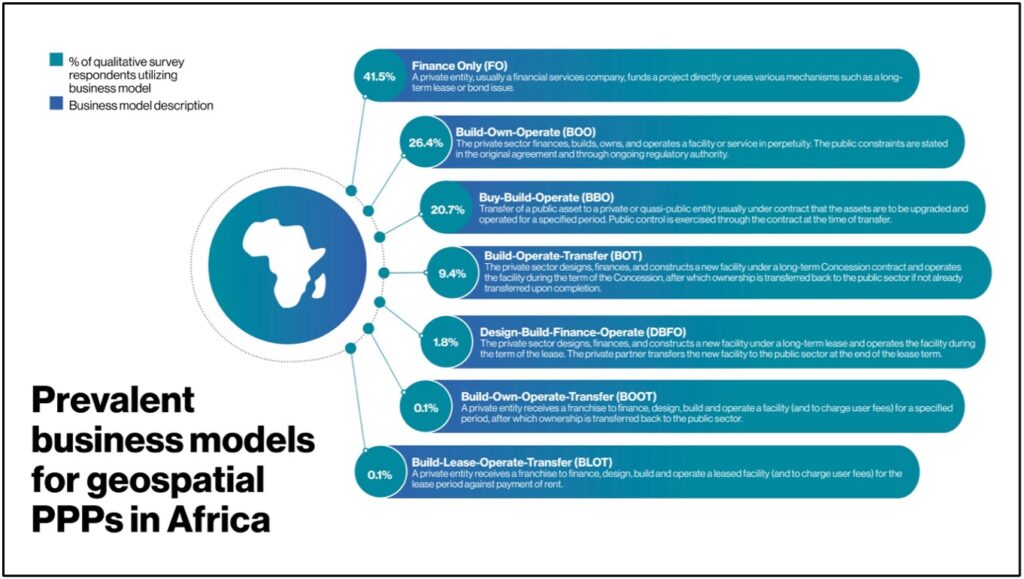

Private sector involvement can come at different levels and within different contractual structures. On the same note, a variety of business models are being employed to structure geospatial PPPs in the recent past. A case in point is the WGIC study of geospatial PPPs and their business models in Africa as described in Figure 1.

Often, the nature of a project and the requirements set forth by the financing partners will dictate the type of business model utilized. WGIC study points to “Finance Only” as the preferred business model for majority of geospatial stakeholders in Africa.

However, each geospatial PPP will be unique in its choice of business model, as each project addresses multiple infrastructure and public sector needs. The business model selection and focus are essential as they help provide the correct direction and information needed when looking at various financing options.

Financial Arrangements

A critical aspect of successful geospatial PPPs is the financial arrangement. Finding the most suitable financial partner(s) and arrangements, although at times difficult, can make the difference between a successful project and one that does not meet the expectations of the parties involved.

Such financial partners include multilateral institutions and bilateral agencies with a development mandate and export credit agencies with a mandate to support domestic businesses pursuing investments in their geography of operations.

Commercial and investment banks also fund PPPs along with government agencies that are set up expressly to aid development projects. Such sources could also be considered when looking for financing.

Generally, the private sector brings specialized financing to PPPs, distinct from public and corporate financing. Although often partially funded through public budgets, they can be entirely funded through private support as well. Project finance is the term used for PPP- funding and is based on several specific characteristics, as listed below.

- Standalone project: The funding raised is for only one project.

- Special purpose project company as the borrower: An independent legal vehicle (project company) is created to raise the funds required.

- High debt to equity ratio: The newly created project company usually has the minimum equity required to issue debt for a reasonable cost, with equity generally averaging between 10 and 30 percent of the total capital required.

- Lending based on project-specific cash flow, not corporate balance sheet: The project company borrows funds from lenders. The lenders look to the projected future revenue stream generated by the project and the project company’s assets to repay the loans.

- Financial guarantees: The government may not provide financial guarantees to the lenders, while developers may provide guarantees often limited to their equity contribution.

Risks and Risk Allocation

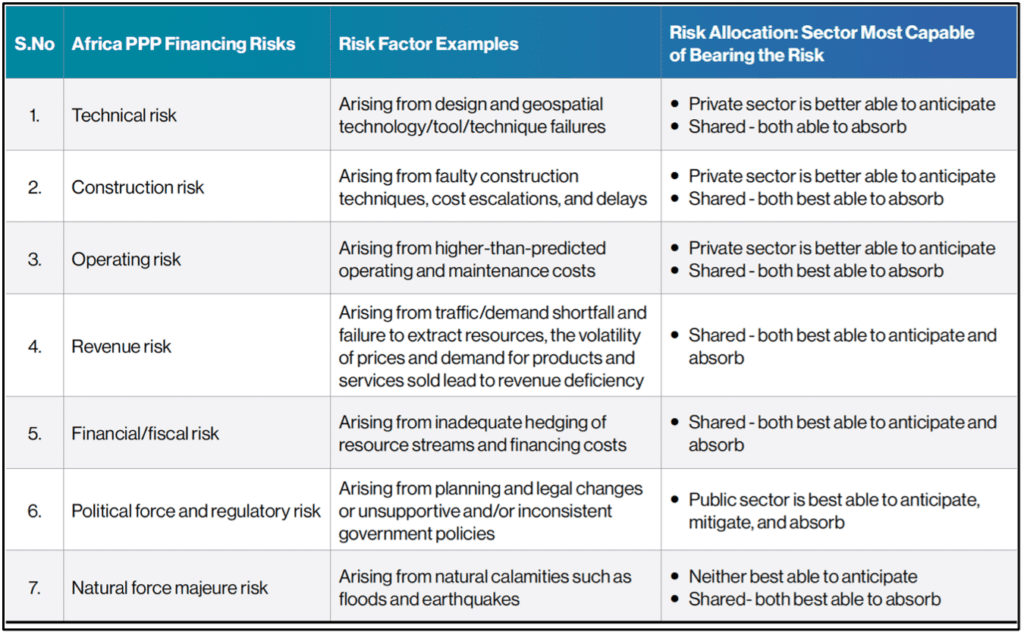

PPPs are collaborative endeavours where the strengths of both the public and private sectors are harnessed, even as the associated project risks are managed jointly. A detailed risk-sharing matrix should, therefore, be developed for each PPP project. An appropriate allocation of risk between the public and private sectors should be established in each project contract to ensure effective management of governmental fiscal risks. The risks associated with geospatial PPPs largely mirror those encountered in any PPP. A typical risk matrix of geospatial PPP and more specifically for Africa is shown in Table 1.

If these risks are taken into consideration when designing the project, many can be alleviated. Such a process improves the chances of securing private financial support and directly contributes to the project’s success. At a minimum, they should be thoroughly evaluated during the planning and design phases and explicitly addressed in contract negotiations to protect both parties.

The public sector/State, nonetheless, always remains the ultimate guarantor of project delivery, and when a private sector concessionaire fails to meet its contractual obligations, State and local governments are forced to shoulder any resulting political, administrative and financial burdens to ensure a project’s completion.

The financial resources needed to complete a PPP infrastructure project are ultimately raised from tax revenue or user fees, and the responsibility for completing the project rests with the State. Government officials must be mindful of these threats and ensure appropriate government support mechanisms are in place to balance bankability and value for money.

Learn more about the business and financial considerations and take home a how-to-guide for developing a geospatial PPP here

Africa Geospatial Public Private Partnerships: Business and Financial Considerations Report

The report demonstrates there are indeed strong needs and compelling stories for developing and supporting geospatial infrastructure and Earth observation (EO) sectors with PPPs in Africa.

The Africa Geospatial PPP Readiness Index ranks fifty-three African nations based on the strength of the enabling conditions and provides detailed guidance on various business tools for developing mature geospatial PPPs. The geospatial PPP how-to guide enumerates the process with a detailed list of steps to follow while developing a geospatial PPP to ensure its success.